Robotic Process Automation (RPA) has evolved from a niche technology to a core component of digital transformation. In times of rising costs, increasing regulation and high agility requirements, companies are looking for ways to make processes more efficient and reliable. RPA addresses precisely this: software bots take on rule-based, repetitive tasks in a stable and scalable manner – usually without profoundly interfering with existing core systems. However, sustainable success depends less on the technology alone and more on a strategically and organisationally well-embedded implementation.

Market dynamics 2025 – figures, drivers and distinctions

Market studies come to very different conclusions depending on their definition (pure RPA software, RPA + services or extended ‘hyperautomation’ including AI/ML, IDP, process mining). It is therefore important to only make comparisons within an identical scope. Regardless of this, all analyses show that the RPA market is growing dynamically and has become a driver of digital transformation worldwide.

💡 SoftGuide Infobox

RPA vs. hyperautomation – clear distinction

RPA: Automates clearly rule-based, digital tasks (UI/API).

Hyperautomation: Combination of RPA with AI/ML, intelligent document processing (IDP), process mining and orchestration.

Practical relevance: Hyperautomation is a separate market (approx. £46.4 billion in 2024; CAGR ~17% until 2034) and cannot be directly compared with RPA market figures.

Table 1: Market figures for 2024/2025 and forecasts for the RPA market

| Source | Market size 2024 | Market size 2025 | Forecast / End value | Period | CAGR |

|

Fortune Business Insights |

18,18 Mrd. USD |

22,58 Mrd. USD |

72,64 Mrd. USD (2032) |

2025–2032 |

18,2 % |

|

Precedence Research |

22,80 Mrd. USD |

28,31 Mrd. USD |

211,06 Mrd. USD (2034) |

2025–2034 |

25,0 % |

|

Data Bridge Market Research |

4,03 Mrd. USD |

— |

36,03 Mrd. USD (2032) |

2024–2032 |

31,5 % |

|

Grand View Research |

3,79 Mrd. USD |

5,00 Mrd. USD |

30,85 Mrd. USD (2030) |

2025–2030 |

43,9 % |

|

Spherical Insights |

22,23 Mrd. USD |

— |

273,89 Mrd. USD (2035) |

2025–2035 |

25,65 % |

Why the figures vary – what studies really measure

The main drivers of the deviations are different market definitions (software vs. software+services; narrow RPA definition vs. inclusion of IDP/AI/process mining) as well as the measurement variable (vendor revenue vs. end-user spending), the base year and the length of the forecast horizon.

Table 2: Comparison of methodologies used in key studies

| Study | Base year | Horizon | Unit | Scope | Special features |

|

Fortune Business Insights |

2024 |

2032 |

USD |

Software + Services |

Moderate CAGR, regional breakdown |

|

Precedence Research |

2024 |

2034 |

USD |

Software + Services |

Services 77.21% (2024); NA share 38.92% (2024) |

|

Grand View Research |

2024 |

2030 |

USD |

Software + Services |

Very high CAGR; cloud share dominant according to study (2024) |

|

Data Bridge Market Research |

2024 |

2032 |

USD |

Software + Services |

Very low output level compared to other sources |

|

Spherical Insights |

2024 |

2035 |

USD |

RPA in total |

Long forecast horizon |

|

Global Market Insights (hyperautomation) |

2024 |

2034 |

USD |

RPA + KI/IDP/Process Mining |

Independent market, not directly comparable to RPA |

💡 SoftGuide Infobox

Term: Intelligent Document Processing (IDP)

- Definition: IDP combines OCR, machine learning (ML) and natural language processing (NLP) to automatically extract and structure information from unstructured/semi-structured documents.

- Distinction: Unlike traditional OCR, IDP understands context (e.g. invoice number, payment terms, customer data).

Practical benefits: Invoice processing, patient file management, contract data extraction, etc. In hyperautomation scenarios, IDP extends RPA to end-to-end processes with unstructured content.

Market drivers in 2025

Technology integration

The trend is towards ‘hyperautomation’: RPA is being combined with AI/ML, IDP, process mining and orchestration. This allows more complex, data-intensive workflows to be automated – right through to the processing of unstructured content.

Cross-industry demand

Financial services (BFSI), healthcare and manufacturing are among the sectors showing high momentum – wherever document processing, compliance reporting or data capture can be automated precisely and scalably.

Cloud & service models

RPA-as-a-Service and deep ERP/cloud integrations accelerate rollouts and enable usage-based scaling – even for SMEs.

Regional perspectives

North America

North America will be the leading region in 2024. The US market is expected to reach around USD 22.32 billion by 2032, with North America holding approximately 44.22% market share in 2024. Strong AI integration in businesses and administration sets benchmarks for other regions.

Europa

More heavily regulated industries (banking, healthcare) are among the pioneers, including in compliance and administrative processes. SMEs are catching up and represent significant growth potential.

Asia-Pacific

Very high growth rates due to e-government programmes, manufacturing automation and digitalisation of SMEs. Studies predict high double-digit CAGRs for APAC until 2034 (e.g. ~27.5%).

Latin America & Africa

Early stage with dynamic growth from a small base, especially in the financial sector and telecommunications; international providers are expanding partnerships and presence.

RPA in practice – industries & examples

RPA increases efficiency and quality across many industries. Typical fields:

Financial services & insurance

- Customer onboarding: Automated document verification, data reconciliation and plausibility checks shorten throughput times and improve ‘first-time-right’.

- Compliance & audit processes: Transaction audits and reporting become consistent and audit-proof.

Healthcare

- Patient registration: Capture/validation from multiple sources, more error-free data flow between admission, billing and archiving.

- Billing: Generate service records, check completeness, electronic transmission – faster cash flow.

Retail & e-commerce

- Inventory management: Automatic synchronisation between ERP and shop reduces stock shortages and overselling.

- Supply chain & shipping: Tracking, status notifications and portal updates in real time.

Public sector

- Application processing: Validation, routing and automatic communication reduce the workload for administrators and shorten processing times.

Note: Specific effects vary depending on the use case, process maturity and scaling. Reliable ROI calculations require clean baselines and a complete TCO analysis.

Strategic success factors for RPA programmes

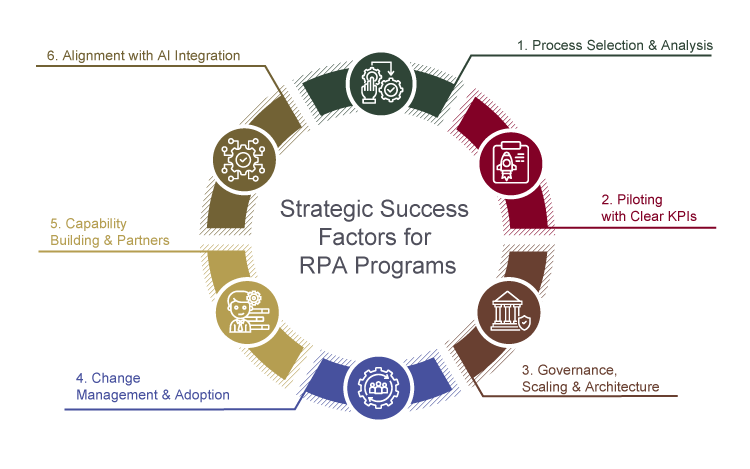

Robotic Process Automation (RPA) has evolved from isolated efficiency measures to a strategic lever for digital transformation. For RPA programmes to have a lasting impact, they must be clearly structured, measurable and designed for scalability from the outset. The following success factors show what companies should look out for in order to realise automation potential effectively and in a future-proof manner.

1. Process selection & analysis: High repetition frequency, stable rules and structured data are ideal candidates. Process/task mining increases hit rate and scalability.

2. Piloting with clear KPIs: Pilot projects provide learning effects and reliable ROI data. Independent surveys report average payback times of between around 12 months (scaled programmes) and ~22 months (broader ‘intelligent automation’ programmes), depending on programme maturity. Vendor-sponsored Forrester TEI studies show some < 6 months – to be considered indicative.

3. Governance, scaling & architecture: A centre of excellence, defined standards, roles and a scalable (cloud/hybrid) bot architecture prevent uncontrolled growth.

4. Change management & acceptance: Transparent communication and training reduce reservations and ensure adoption.

5. Competence building & partners: SMEs in particular benefit from neutral support (e.g. SoftGuide research service) for selection, PoC and rollout.

6. Focus on AI integration: RPA is growing towards ‘intelligent automation’ with AI modules, low/no code and process mining – this should be reflected in the automation roadmap.

Conclusion

RPA will be a key lever of digital transformation in 2025. Despite diverging market sizes, the trend is clearly upwards. RPA delivers measurable efficiency and quality gains, especially in regulated industries. Clean process selection, governance, pilot KPIs, training and the gradual integration of AI-based capabilities are crucial to success. Those who invest now in scalable architecture and organisational models often realise a positive ROI in the first year, while also strengthening resilience and innovation capabilities.